extended child tax credit 2022

The credit will increase from. However Congress had to vote to extend the payments past 2021.

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year.

. The monthly payments from 2021 have finished but there is another lesser-known federal. The good news is. Therefore child tax credit payments will NOT continue in 2022.

Although there are some similarities the child tax credit in 2021 differs dramatically from the allowance in 2020. 2022 changes to child tax credit. Real Estate Sales.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered. Dont Miss an Extra 1800 per Kid. 2021 and 2022 tax credit difference.

The 2021 tax credit for dependents age 18 and older at year-end such as anolder child or elderly relative is up to 500. Poverty and CTC continued. The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start of the current tax season.

The absence of one of the legislations most popular provisions an extension of the expanded child tax credit ctc benefits through 2022 is. IRS Child Tax Credit Money. 1 2022 the child tax credit reverted to what it was originally.

For 2022 this credit is set to apply todependents age 17. Expanded Child Care Credit Taxpayer-Friendly Changes for 2021 - April 5 2022. What is the new Child Tax Credit alternative available in 2022.

The child tax credit isnt going away. Here is what you need to know about the future of the child tax credit in 2022. 2022 Child Tax Credit Per ChildBut as part of the 19 trillion coronavirus relief package president joe biden expanded the program increasing the payments to up to 3600.

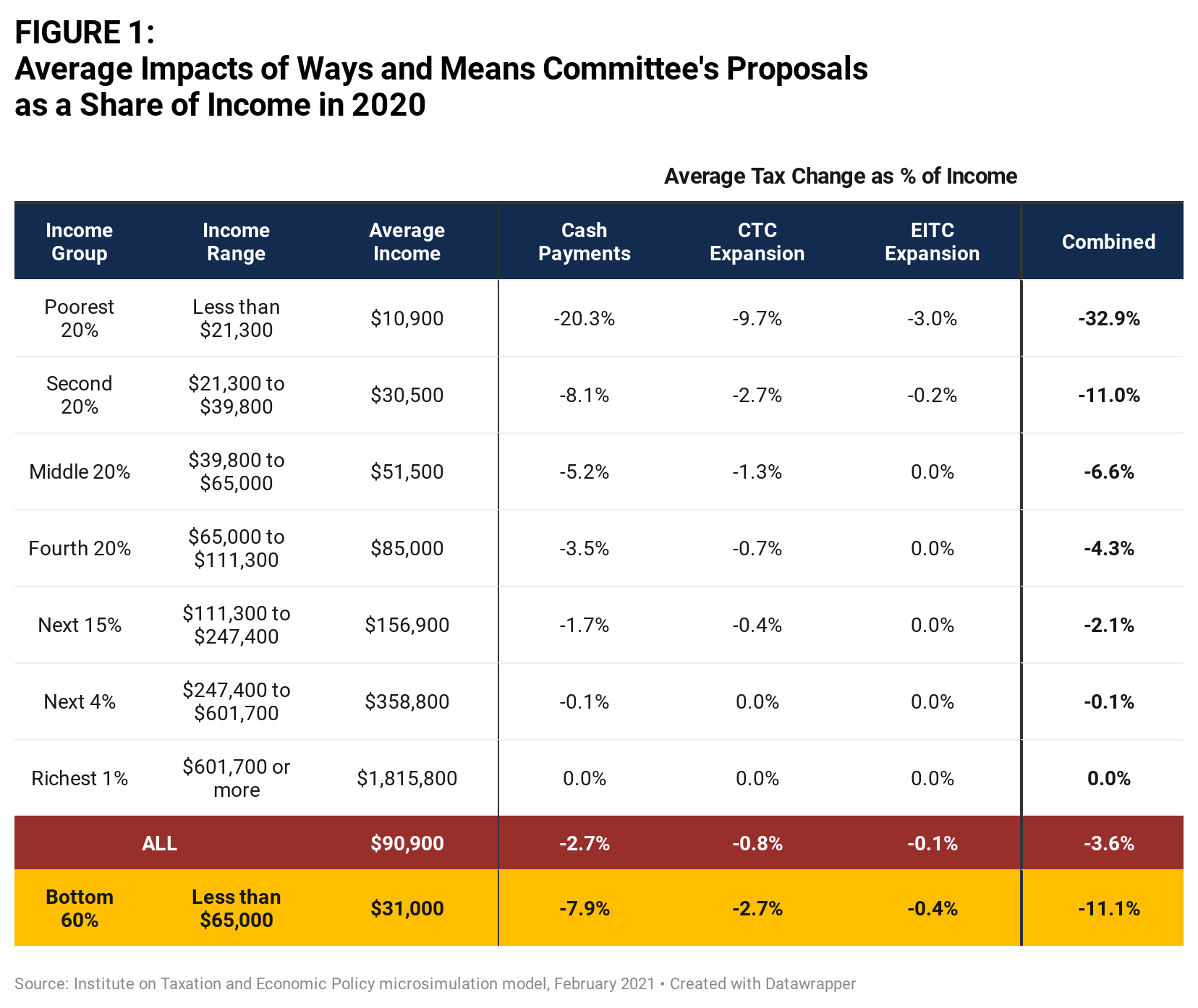

The Build Back Better Act would not only extend full refundability to the 2022 child tax credit but it would make the credit fully refundable on a permanent basis. It hasnt been extended through 2021 and as of Jan. Most parents who received monthly payments in 2021 will have more child tax credit money coming this year.

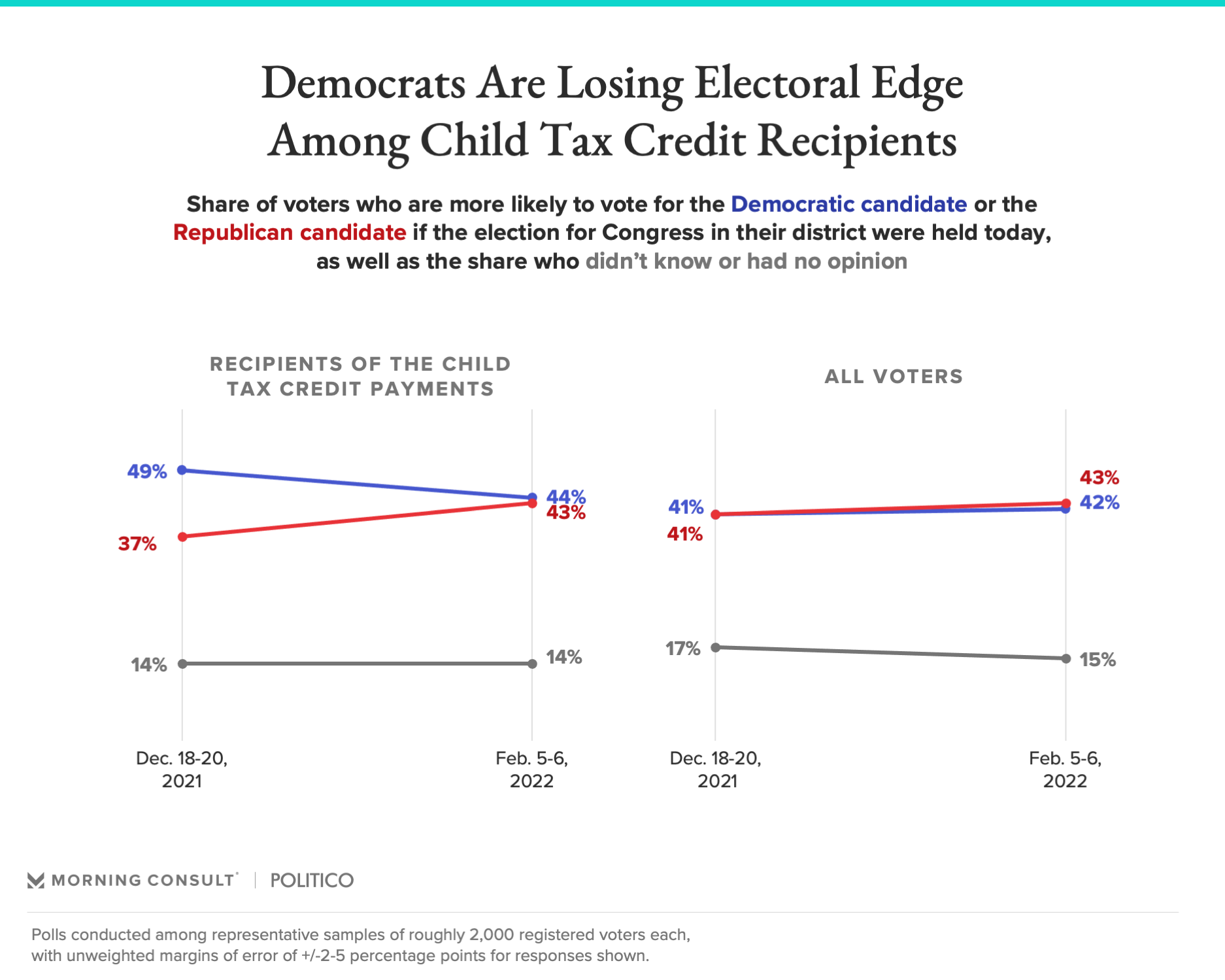

The study found that the overall monthly child poverty rate rose sharply between December 2021 and January 2022 Last March Democrats in. However despite calls for the expanded Child Tax Credit payments to be continued into 2022 progression has not gone as many in the Democrat party would have hoped. Under the BBB spending plan the current expanded Child Tax Credit will be extended for another year bringing the total amount paid over 2 years to a maximum of.

That meant if a household claiming the credit owed the IRS no money it. Prior to 2021 the Child Tax Credit maxed out at 2000 per child and was only partially refundable. 2000 per child in the form of a tax refund instead of.

Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less. 100 Meals Deduction for 2021 and 2022 - March 8 2022.

Government disbursed more than 15 billion of monthly child tax credit payments in July. 31 2022 in his Build Back Better.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Child Tax Credit Toolkit The White House

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Expanded Child Tax Credit Briefly Slashed Child Poverty Here S What Else It Did In 2022 Child Tax Credit Poverty Children Tax Credits

Solar Tax Credit Extended For Two Years In 2021 Residential Solar Solar Tax Credits

Should The Child Tax Credit Be Limited To Those With Lower Incomes As Manchin Prefers

A Stimulus Payout Worth 5 000 Is Available To Eligible Parents Of Newborn Babies While Parents Nationwide Wait For In 2022 Child Tax Credit Tax Credits Tax Refund

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

The Child Tax Credit Checks Are Here How Are Parents Spending Them The Lily In 2022 Child Tax Credit Tax Credits Form Of Government

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet