capital gains tax proposal

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons.

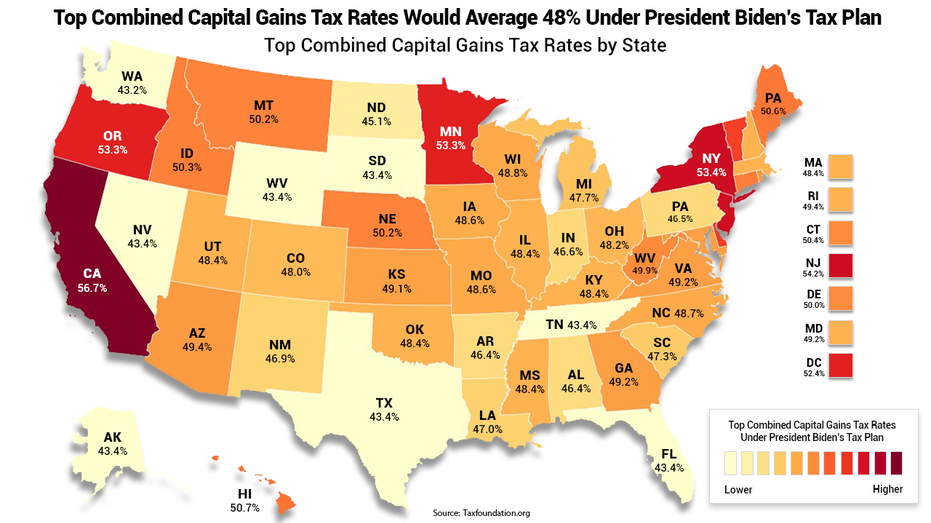

Mapped Biden S Capital Gain Tax Increase Proposal By State

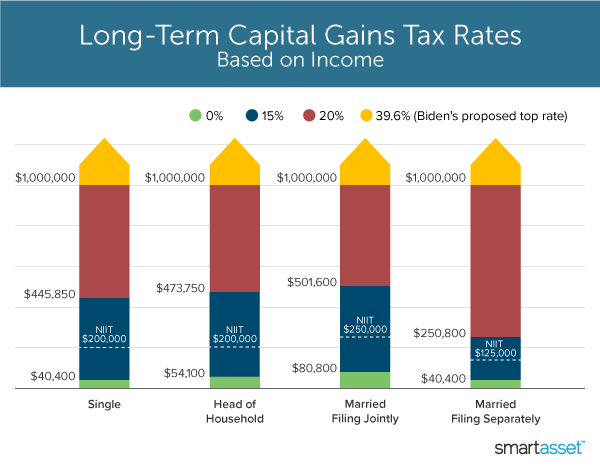

Currently long-term capital gains are in general.

. Under the forthcoming proposal dubbed the American Families Plan the capital gains tax rate could increase to 396 from 20 for Americans earning more than 1 million a. The OTSs consultation - which received over 1000 responses - revealed a range of areas in which Capital Gains Tax was apparently counter-intuitive and creates odd incentives. As per the report the panel proposed a long-term capital gains LTCG tax of 10 per cent on profits from the sale of equity assets that are held for more than a year.

The tax hike would apply to households making more than 1. It hasnt been noticed much but proposed changes to capital-gains taxes have good news for some of the highest-earning Americans and bad news for those earning. The Problems With an Unrealized Capital Gains Tax.

In the case of all other assets a 20 tax with indexation on gains on sale post holding a period of 36 months was proposed. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. President Donald Trump s main proposed change to.

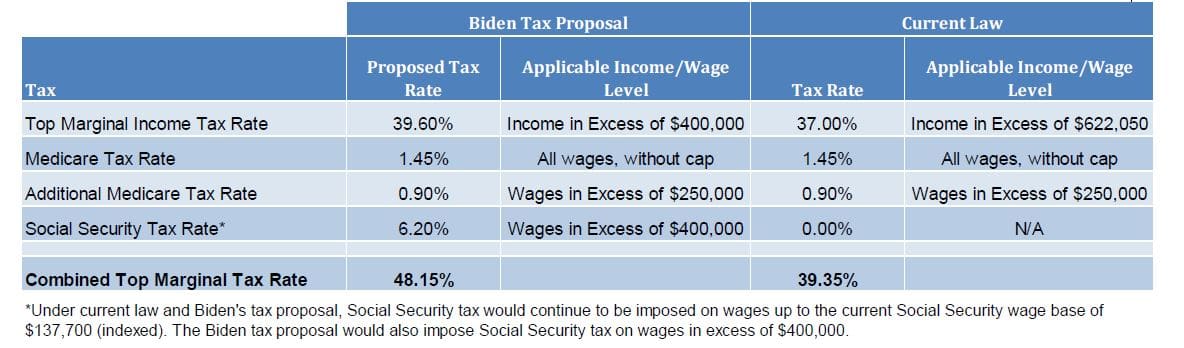

The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. However one of the Presidents proposals is to tax long term capital gains and qualified dividends as ordinary income if your taxable income exceeds 1m.

This rate hike will affect stocks bonds. The Center Square Washington lawmakers have advised the Department of Revenue that its proposed rule concerning the states capital gains tax should be labeled as. Say you make a.

Given what the president has proposed the wealthiest people in the US could see a significant hike in the capital gains tax rate. The capital gains tax has long been part of the political tug-of-war and with the release of President Bidens FY2022 budget proposal the change to the capital gains tax. The top marginal income tax bracket.

Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to the tax code that affect the capital gains tax. Subscribe to receive email or SMStext notifications about the Capital Gains tax. House Democrats proposed a top 25 federal tax rate on capital gains and dividends.

It would apply to single taxpayers with over 400000 of income and married. It would apply to those with more than 1 million in annual income. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

Part of a larger bill uncontroversially titled the American Families Plan Biden would raise taxes on the well off in a few different ways.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

What S In Biden S Capital Gains Tax Plan Smartasset

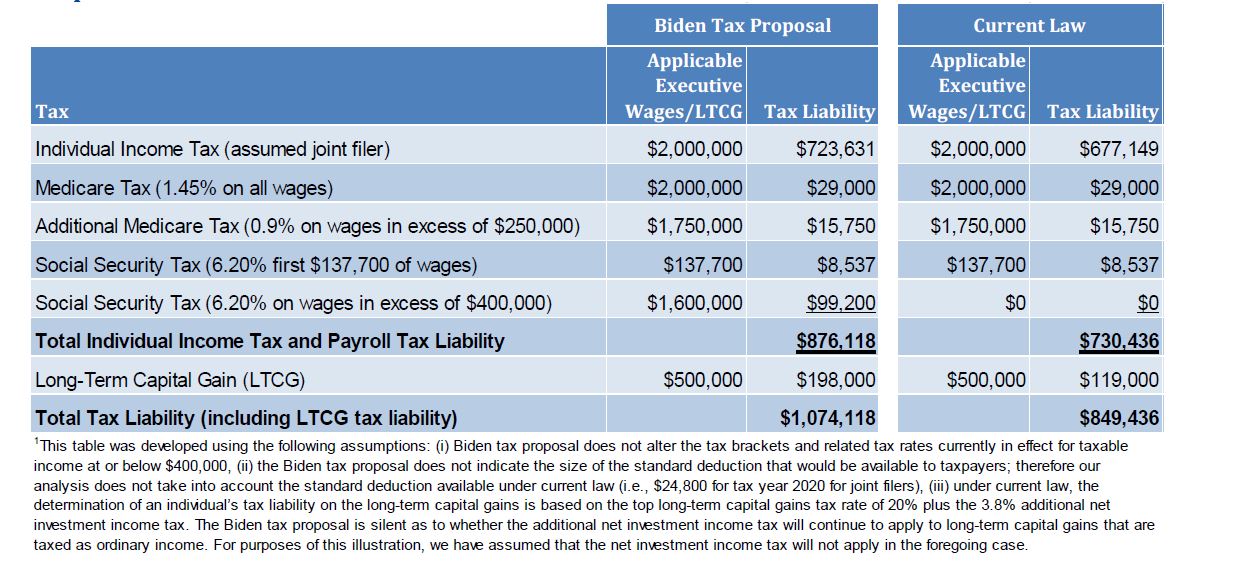

Biden S Tax Proposal And Potential Impact On Executive Compensation And Stock Ownership Meridian

Biden S Tax Proposal And Potential Impact On Executive Compensation And Stock Ownership Meridian

Sdr Blog The Biden Tax Proposal What You Need To Know

What Can The Wealthy Do About Biden S Proposed Tax Increases

What Biden S Capital Gains Tax Proposal Could Mean For Your Wallet Fox Business

Biden S Capital Gains Tax Proposal Puts Estate Planners To Work Wsj

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Analyzing Biden S New American Families Plan Tax Proposal

Biden Plans To Nearly Double Capital Gains Tax For Wealthy

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy